Introduction:

This case study delves into the journey of Unity Bank, a prominent player in the banking industry, as it faced various challenges and successfully implemented solutions to drive operational efficiency and customer satisfaction. By addressing key areas such as vendor tracking, custom dashboard analysis, ticket management, warranty leakage, information sharing, repair or replace decisions, and asset servicing errors, Unity Bank was able to achieve significant improvements.

Challenges:

Absence of Vendor Tracking System: Unity Bank struggled with tracking and managing vendor performance, leading to inefficiencies and potential quality issues.

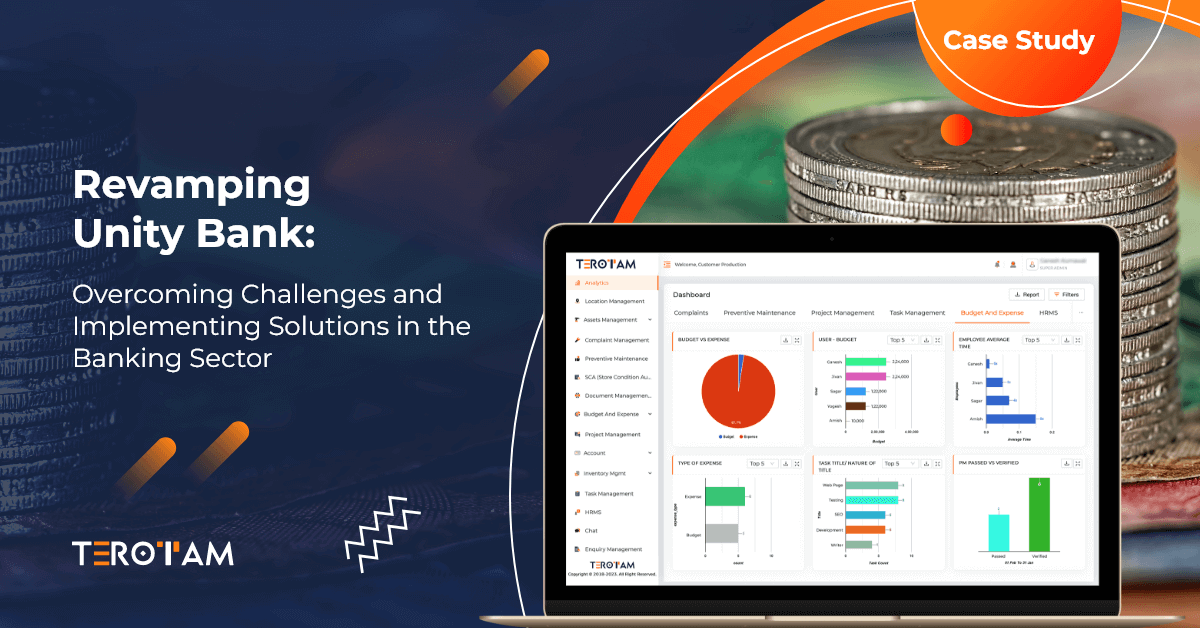

Lack of Depth Analysis Custom Dashboard: The bank lacked a comprehensive custom dashboard for in-depth analysis, hindering data-driven decision-making and performance monitoring.

Lack of Ticket Management System: The absence of a structured ticket management system resulted in difficulties in tracking and resolving customer complaints and issues.

Warranty Leakage: Unity Bank faced challenges in managing warranty claims, resulting in financial losses and customer dissatisfaction.

Lack of Information Sharing: The bank struggled with effective information sharing across departments and branches, leading to communication gaps and operational inefficiencies.

Difficult Repair or Replace Decisions: Unity Bank encountered challenges in making informed decisions regarding repairing or replacing assets, impacting cost management and customer service.

Asset Servicing Errors: Inefficient asset servicing processes resulted in errors and delays, negatively impacting customer experience and operational efficiency.

Solutions:

Asset Management: Unity Bank implemented an advanced asset management system to track, maintain, and optimize asset performance, reducing downtime and improving operational efficiency.

Complaint Management: The bank introduced a robust complaint management system to streamline ticketing, resolve customer issues promptly, and enhance customer satisfaction.

Escalation Mechanism: The bank established an escalation mechanism to ensure timely resolution of critical issues and to maintain service level agreements with customers.

Staff Management: Unity Bank implemented efficient staff management practices, including training and performance evaluation, to enhance employee productivity and service quality.

Vendor Management: The bank enhanced its vendor management processes, ensuring better vendor selection, performance monitoring, and relationship management.

Branch Management: Unity Bank improved branch management practices, optimizing resource allocation and standardizing processes across branches for consistent service delivery.

Analysis & Reports: The bank developed customized analysis dashboards to provide real-time insights, enabling data-driven decision-making and performance tracking.

Conclusion:

Through strategic implementation of solutions in areas such as asset management, complaint management,00 escalation mechanisms, staff and vendor management, branch management, and analysis reporting, Unity Bank overcame its challenges and achieved notable improvements in operational efficiency, customer satisfaction, and financial performance. The case study of Unity Bank serves as an inspiration for other organizations in the banking industry to address their own challenges and implement effective solutions for long-term success.