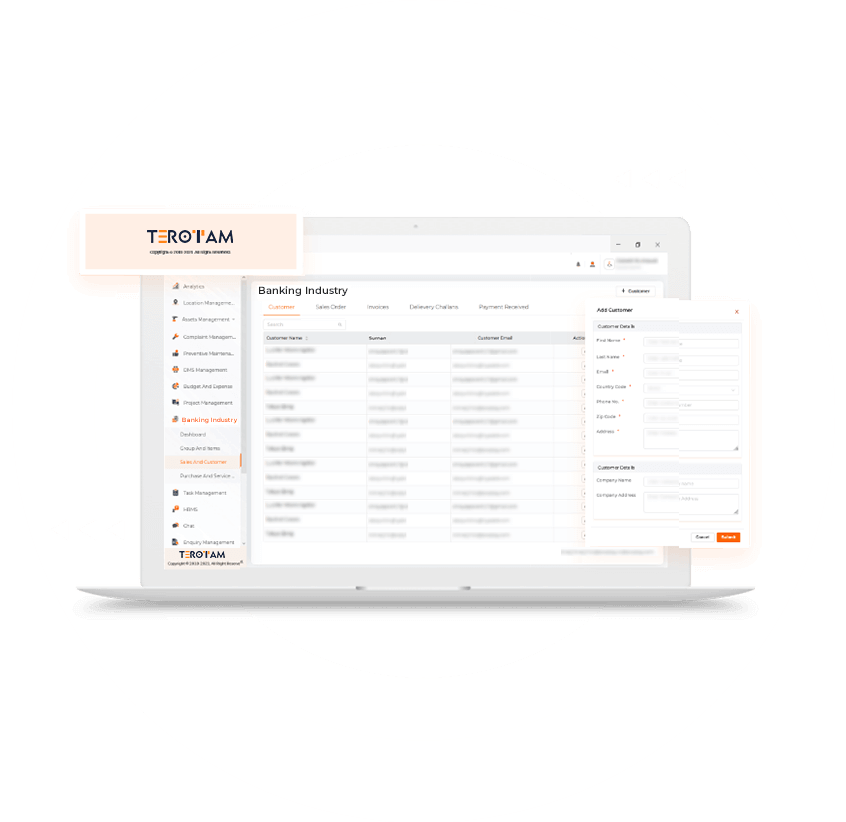

Why You Need CMMS Software for Banking Industry?

The banking industry relies heavily on the smooth operation of its physical infrastructure, which includes bank branches, ATMs, and data centers. To ensure the seamless functioning of these assets, the banking industry needs Computerized Maintenance Management System (CMMS) software. CMMS software enables banks to effectively manage their maintenance activities, improve asset performance, and enhance operational efficiency. By implementing CMMS software, banks can schedule and track routine maintenance tasks, such as equipment inspections, preventive maintenance, and repairs. This proactive approach helps minimize downtime and ensures that critical banking services are available to customers without interruption.

CMMS software also facilitates the management of spare parts and inventory, allowing banks to streamline their procurement processes and optimize their stock levels. The banking industry is subject to stringent regulatory requirements and compliance standards. CMMS software plays a crucial role in helping banks meet these obligations. It provides a centralized platform for recording maintenance activities, generating reports, and documenting compliance-related information. This documentation is essential for audits and regulatory inspections.

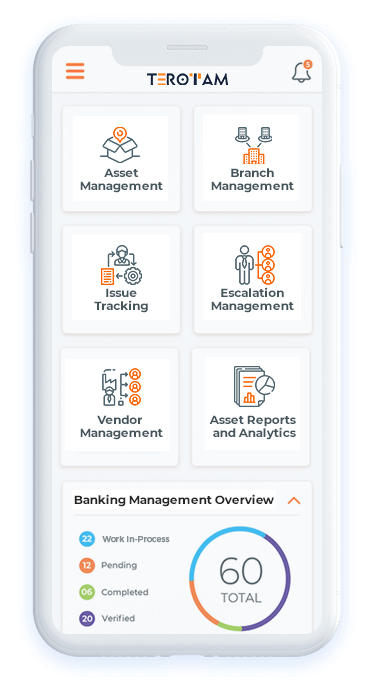

Affirmative Asset Management

TeroTAM’s banking asset management software helps banks effectively manage their physical assets, This enables banks to optimize asset performance, track their condition, and plan maintenance activities accordingly which in return increases the lifetime value of an asset.

TeroTAM CMMS software helps banks maintain their assets in optimal condition, leading to improved reliability. With Scheduling regular maintenance jobs and tracking asset performance, it helps identify and address potential issues before they result in failures or downtime.

Bank asset management software aids in extending the lifespan of banking equipment. Regular maintenance, inspections, and timely repairs ensure that assets are kept in good working condition, preventing premature wear and tear and extending their lifespan.

Enhanced Operation Efficiency

Bank management software streamlines maintenance operations and improves operational efficiency with a centralized platform for managing work orders, assigning tasks to maintenance technicians, tracking their progress, and enabling efficient communication and collaboration among maintenance teams.

It helps streamlines the management of work orders in the banking industry. It helps identify the maintenance and other work plans and work orders can be generated, assigned to technicians, and tracked through the system.

Regular inspections can be planned and tracked using the software, ensuring that critical equipment remains in optimal working condition. By proactively addressing maintenance needs with preventive maintenance practices, banks can reduce the risk of breakdowns, enhance reliability, and minimize downtime.

Seamless Staff and Vendor Management

The Bank management software system lets you work with your staff, vendor, or customer with flawless frequency and efficiency with its various modules that dedicatedly manages respective task and also helps you keep them satisfied with complaint management and their well-planned escalation.

The dedicated modules within our CMMS system for staff and vendors let them create users for themselves and they can use the software for different task management using their portal they can also communicate with the internal team.

As complaint management software for banks, any complaints or issues can be documented with a ticket and can be assigned to respective team members to solve it and if not resolved it can be easily escalated to the superior level for expertise execution and solution.

Rigorous Reporting and Regulatory Compliance

This system facilitates compliance with regulatory requirements in the banking industry. It provides a centralized system for documenting maintenance activities, generating reports, and tracking compliance-related information, ensuring that banks can demonstrate adherence to regulatory standards during audits and inspections.

Banking CMMS software enables banks to generate comprehensive reports on maintenance activities, asset performance, and compliance-related data. These reports can be used to monitor key performance indicators, track maintenance costs, and demonstrate compliance with regulatory requirements.

With this bank management software, banks can improvise their location management effectively. Multiple branches of the bank and their assets can be managed and monitored through a centralized system. It also works like risk management software for banks where it helps to identify risks associated to different branch locations to rationalize it.

Advanced ATM Monitoring Management

With ATM monitoring and GPS tracking capabilities, Our CMMS software for Banking empowers financial institutions to optimize their ATM management processes. It enables proactive maintenance, reduces downtime, enhances security, and improves the overall operational efficiency of the ATM network.

This system allows real-time monitoring of ATM performance, including cash levels, transaction success rates, and hardware status. This proactive approach enables banks to identify and resolve issues promptly, ensuring uninterrupted service to customers.

GPS tracking helps to monitor the physical location of ATM machines, ensuring they are deployed in strategic locations for maximum accessibility and profitability. GPS tracking also aids in tracking malfunctioned ATMs, minimizing financial losses, and enhancing security measures.

Innovate 360-degree to Achieve Excellence in Banking Industry with TeroTAM

Transfor Banking Landscape with Harmonizing Asset Management, Workflows, and Data-Driven Insights for Banking Excellence

Manage your Banking Business in a Palm-Easy Way with Smartphone

Real-time access to maintenance data and task management on mobile devices.

Increased flexibility and responsiveness for maintenance teams on the go.

Seamless communication and collaboration between field technicians and the office.

Efficient tracking and resolution of maintenance requests through mobile notifications.

Advanced Features of Banking CMMS Software Solution

Industries We Serve

Maintenance

Education

Oil & Gas

Real Estate

Banking

Equipment

Healthcare

Non-Profit

Government

Fire Department/EMS

Hotels

Food & Beverage

Do you have questions?

Be a master in your domain with our CMMS tech solutions and smart ideas

How user-friendly is your CMMS software for Banks?

Our CMMS solution for banks is designed to be user-friendly and intuitive. It typically features user-friendly interfaces, interactive dashboards, and streamlined workflows to ensure ease of use for maintenance technicians, administrators, and other users.

Does Your CMMS software be customized to meet the specific needs of Banks?

Yes, TeroTAM offers customization options to meet the specific requirements and workflows of banks. This allows banks to tailor the software to their unique maintenance processes, compliance needs, reporting preferences, and other specific requirements.

Can Your CMMS software integrate with other Banking systems?

Definitely. TeroTAM CMMS system integrates with other banking systems such as asset management systems, enterprise resource planning (ERP) systems, and customer relationship management (CRM) systems. The integration allows for seamless data exchange, improved collaboration, and a more comprehensive view of maintenance operations.

Do Support and Training provided for Banks implementing CMMS software?

We at TeroTAM, typically offer support and training to banks during the implementation process. This can include onboarding sessions, training materials, user documentation, and ongoing technical support to ensure a smooth transition and effective utilization of the software.