Businesses have been investing more and more in IT due to digital transformation. Client happiness is unquestionably the foundation of this. Companies concentrated on enhancing their business procedures and services based on consumer satisfaction due to increased competition across all industries. The main goal of the IT expenditures made in this regard was to enhance and simplify the service provided to the customer.

The IT infrastructures of businesses have grown increasingly complicated as a result of the IT-related purchases made. As a result, complexity started to hinder businesses’ ability to innovate by making the IT environment challenging. This served as a warning that businesses making IT infrastructure investments now need to assess and manage their technology stacks.

The techniques and methodologies used to enhance the technology portfolio and operations of businesses include enterprise architecture, IT service management, IT asset management, and IT Infrastructure Library.

What Does IT Asset Management Mean for the Banking Industry?

First, we must define IT asset management in order to comprehend what it means for the banking industry. The process of ensuring that all assets are tracked, updated, deployed, maintained, and disposed of as needed falls under the umbrella of IT asset management. To put it simply, all assets are monitored and used as needed. Asset theft and asset loss can be prevented by tracking and monitoring your assets. IT asset management is the term used to describe all of these tasks in the banking industry.

One of the crucial fundamental business operations for banks is IT asset management. To correctly and effectively manage their constantly expanding IT systems, banks need an ITAM policy. ITAM aids banks in identifying security issues, maintaining compliance with regulations, and monitoring their technological stacks.

Banks must develop and assess inventories of software, hardware, integration, and related IT assets utilized in business processes in order to create an effective IT environment. Inventories of on-premise, SaaS, cloud apps, computers, monitors, servers, phones, printers, routers, system integrations, and data integrations should be made as part of IT asset management.

Importance of IT Asset Management in the Banking Industry

Since there is no statistical information on the usage of the assets in IT portfolios, companies frequently incur excessive license and maintenance expenses for the software and gear they do not utilize. In addition to this, a lot of software and hardware acquisitions are made as a result of procedures like ineffective departmental cooperation, organizational changes, and project changes. By keeping track of information on the history and present knowledge of all assets, IT Asset Management plays a significant part in establishing and regulating an organization’s IT infrastructure.

The banking sector is one of the most fiercely competitive in the world. As financial technologies advanced, traditional banking’s role became less and less important. Banks began to invest in their IT as a result of financial technology’s ability to provide consumers with solutions that make their lives easier and allow for the creation of a more dynamic structure.

In order to continue serving their customers and to safeguard themselves from hazards, banks must have a secure and efficient IT infrastructure. All banks got the chance to put their IT capabilities to the test during the current COVID-19 pandemic. Banks with adequate IT were able to complete this process without suffering any losses, whereas banks with inadequate IT encountered a number of issues.

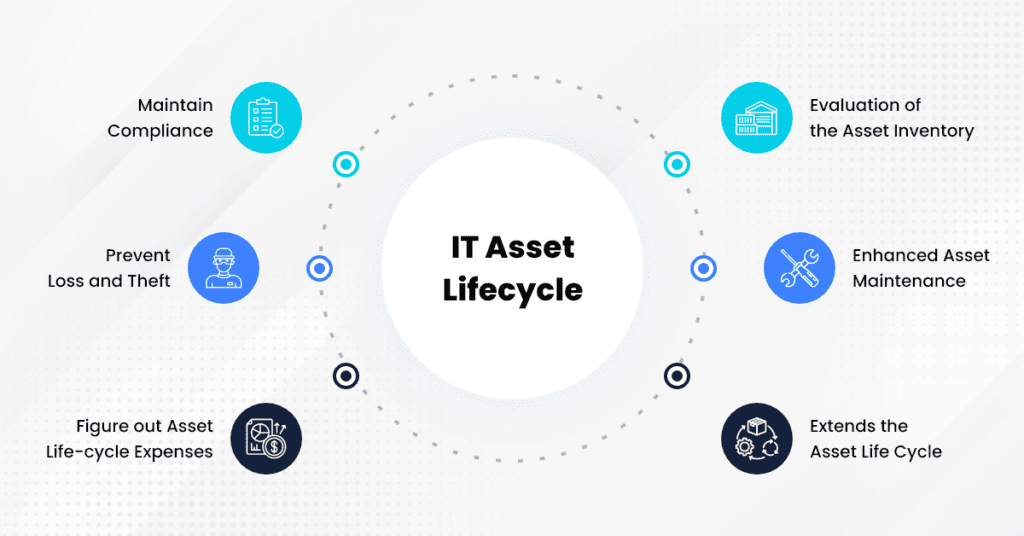

Benefits of IT Asset Management in the Banking Sector

1. Evaluation of the Asset Inventory

Understanding the types of assets that a company holds is necessary for the assessment of its asset inventory. This is the first and most important phase because it’s crucial to know how many assets someone has in their hands in order to manage them effectively. Therefore, the financial institution must take the following things into account while evaluating the inventory:

- Precise Asset Counts

- Asset Locations

- Assessment of each Asset

- Records of the day and time that an asset was acquired

- The Anticipated Asset Life Cycle

2. Enhanced Asset Maintenance

For the banking industry to perform its everyday operations, assets are absolutely essential. A delay in work activity may result if certain assets fail or stop working. Asset upkeep is essential for this reason. When you have numerous assets to keep track of, it gets challenging. Software for managing IT assets schedules maintenance for each piece of equipment. As a result, since this software notifies you in advance of maintenance, maintenance work does not need to be recorded manually.

3. Extends the Asset Life Cycle

Every asset, whether it be a building, a computer, or a vehicle, needs to be properly maintained and cared for. Even software requires regular updates in order to function effectively. Asset management prioritizes maximizing value, which involves fixing, caring for, and maintaining each asset to maximize its lifespan. Banks can buy new assets less frequently through this method because they won’t have to retire or sell old ones as quickly.

4. Figure out Asset Life-cycle Expenses

Asset managers in the banking sector should compute the total life-cycle costs of each asset if they want their asset management plans to be accurate. The error of just including in the initial acquisition costs is one that many banks’ asset managers commit. Throughout the asset’s life cycle, extra charges including maintenance costs, condition and performance models, as well as disposal costs, are likely to arise.

5. Prevent Loss and Theft

A key aspect of asset management is keeping track of assets and following their every step inside a bank. Tracking reduces the possibility of theft and loss, especially for more mobile and portable assets like computer gear and retail goods, however it can also be used for larger assets like machinery or cars. Banks can attach a barcode or GPS tracker to any asset to make it simple to always know where it is. Organizations can lower their budget for replacing lost or stolen items by using asset management.

6. Maintain Compliance

Compliance is crucial to daily operations in many different businesses, including banking, financial services, healthcare, and government. If compliance is not upheld in the banking industry, there may be fines, penalties, or even more serious consequences like workplace accidents or security breaches. Organizations may prioritize compliance, lower risk, and minimize any legal difficulties by using asset management to keep track of this data as well as additional information.

Experience the Systematic and Sustainable IT Asset Management with TeroTAM..!!

IT asset management software aids in the appropriate tracking of the numerous assets that a bank owns. Software for IT asset management can help the bank cut back on wasteful spending. It might be advantageous for your banking industry. You’ll observe increased worker productivity, inventories, lower costs, and better service, as well as improved IT asset visibility.

The IT asset management system from TeroTAM is one of the most effective tools available for use across all company sectors. TeroTAM provides banks and financial institutions with a hassle-free way to track their IT assets however they want, with customizable features, unlimited users, simple data import and export, as well as easy integration with legacy systems. TeroTAM is powered by an intuitive cloud infrastructure and user-friendly interface. Giving the asset a barcode and tagging it is simple. To track and manage the whole lifecycle of your IT assets whenever and whenever you need, all you need to do is carry about your smartphone.

Still not convinced?.. Don’t worry, send us your query at contact@terotam.com or schedule your appointment now with our experts.